Introduction

Balancing financial responsibilities on a tight budget can be challenging, especially when trying to save money, pay off debt, and afford essential insurance like life insurance and long-term care. However, with careful planning, prioritization, and discipline, you can achieve financial stability and security. This guide explores practical strategies for managing these financial priorities even on a limited income.

1. Understanding Your Financial Situation

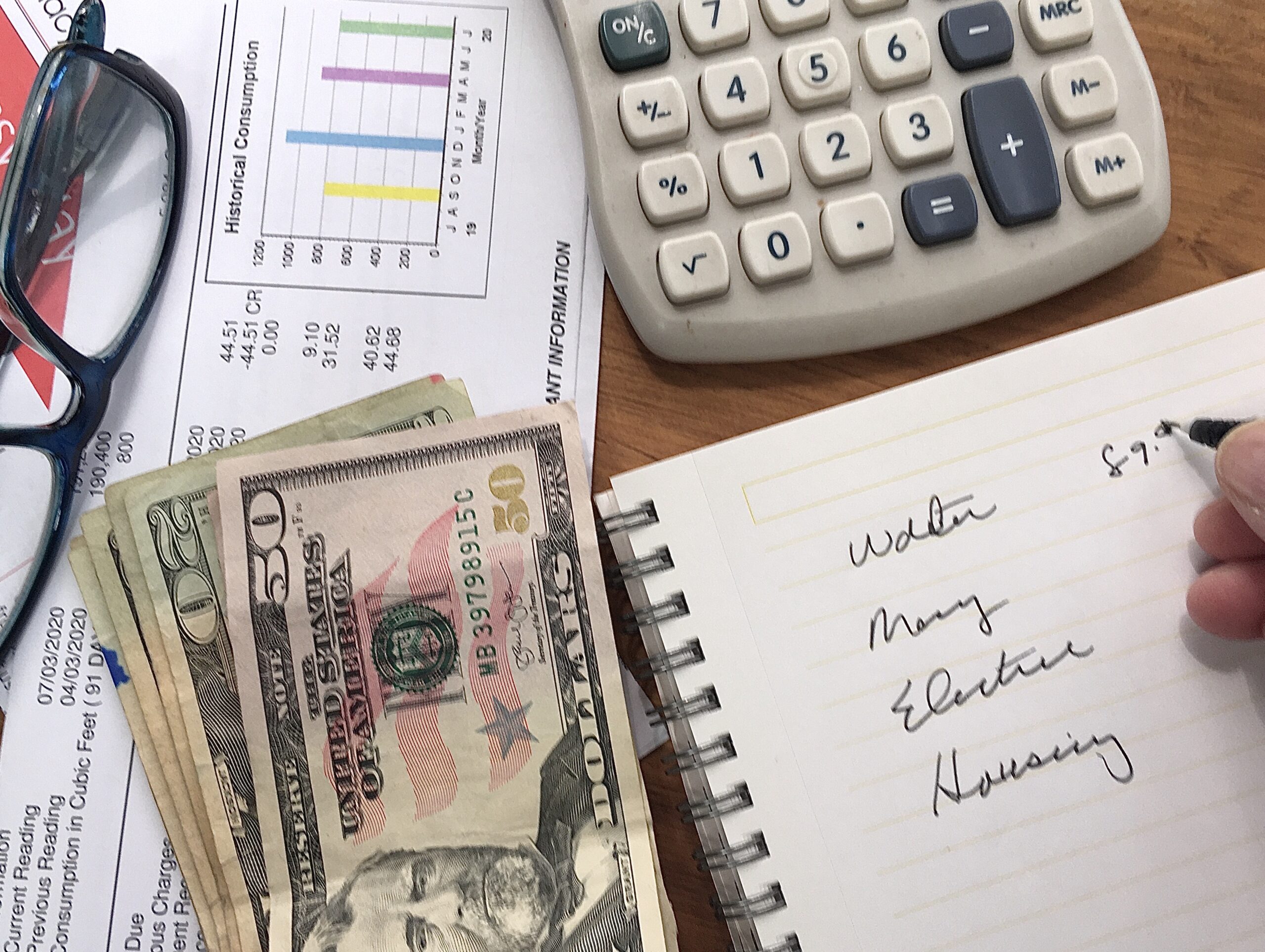

A. Assess Your Income and Expenses

Track Income: List all sources of income, including salary, side gigs, and any other earnings.

Categorize Expenses: Break down expenses into categories such as housing, utilities, food, transportation, debt payments, and discretionary spending.

Calculate Net Income: Subtract total expenses from total income to determine your net income.

B. Identify Financial Pain Points

Analyze Spending Patterns: Review where your money is going and identify areas where you can cut back.

Highlight Debt Levels: Understand your debt situation, including balances, interest rates, and minimum payments.

C. Set Realistic Financial Goals

Prioritize Needs: Focus on essential expenses and obligations first, such as rent, utilities, and minimum debt payments.

Define Short-Term Goals: Establish immediate objectives like building a small emergency fund or making an extra debt payment.

Long-Term Goals: Include saving for life insurance, long-term care, and debt payoff strategies in your planning.

2. Creating a Practical Budget

A. Develop a Zero-Based Budget

Allocate Every Dollar: Assign every dollar of your income to specific expenses, savings, or debt payments, ensuring no money is left unallocated.

Adjust for Priorities: Prioritize essential expenses and obligations, then allocate remaining funds to savings, debt repayment, and insurance premiums.

Use Budgeting Tools: Utilize apps or spreadsheets to track and manage your budget effectively.

B. Reduce Non-Essential Spending

Cut Unnecessary Expenses: Identify discretionary spending that can be reduced or eliminated, such as dining out, subscriptions, or entertainment.

Practice Frugality: Adopt cost-saving measures like cooking at home, using public transportation, and shopping for sales.

Seek Alternatives: Look for cheaper alternatives for necessary expenses, such as switching to a more affordable phone plan or reducing energy usage.

C. Allocate Funds for Savings and Debt

Savings: Aim to save a small portion of your income, even if it’s just $10-$20 per week, to build an emergency fund.

Debt Payments: Allocate extra funds towards debt payments, focusing on high-interest debt first to reduce overall interest costs.

3. Strategies for Paying Off Debt

A. Prioritize Debt Repayment

High-Interest Debt: Focus on paying off high-interest debt first to reduce interest costs and accelerate debt repayment.

Debt Snowball Method: Start by paying off the smallest debts first to build momentum and motivation.

Debt Avalanche Method: Concentrate on paying off the debt with the highest interest rate first to save on interest over time.

B. Negotiate and Consolidate Debt

Negotiate Lower Interest Rates: Contact creditors to negotiate lower interest rates or payment plans.

Consolidate Debt: Consider consolidating multiple debts into a single loan with a lower interest rate to simplify payments and reduce interest costs.

C. Avoid Accumulating New Debt

Limit Credit Card Use: Use credit cards only for necessary purchases and aim to pay off the balance in full each month.

Build an Emergency Fund: Establish an emergency fund to cover unexpected expenses and avoid relying on credit.

4. Saving on a Tight Budget

A. Start Small and Be Consistent

Automate Savings: Set up automatic transfers to a savings account to ensure consistent contributions, even if they are small.

Save Spare Change: Use apps or banks that round up your purchases and deposit the spare change into a savings account.

Save Windfalls: Allocate bonuses, tax refunds, or other unexpected income directly to savings.

B. Utilize High-Interest Savings Accounts

Choose the Right Account: Opt for savings accounts or certificates of deposit (CDs) that offer higher interest rates to maximize growth.

Avoid Fees: Select accounts with low or no fees to prevent diminishing your savings.

C. Build an Emergency Fund First

Set a Goal: Aim to save at least $500-$1,000 initially for unexpected expenses.

Increase Over Time: Gradually build the fund to cover 3-6 months of living expenses to provide a more substantial financial cushion.

5. Affording Life Insurance

A. Understand Your Life Insurance Needs

Evaluate Coverage Amount: Determine how much coverage you need based on your financial obligations, income replacement, and family needs.

Choose the Right Type: Consider term life insurance for more affordable premiums, which provides coverage for a specific period.

Compare Policies: Shop around and compare different policies and providers to find the best rates and coverage.

B. Save on Premiums

Opt for Term Insurance: Term life insurance is generally more affordable than whole life insurance and can be tailored to your specific needs.

Bundle Policies: Check if you can bundle life insurance with other policies (e.g., auto or home insurance) for discounts.

Maintain a Healthy Lifestyle: Non-smokers and those in good health typically qualify for lower premiums.

C. Adjust Coverage Over Time

Review Annually: Reassess your coverage needs annually or when significant life changes occur (e.g., marriage, children, mortgage).

Adjust as Needed: Increase or decrease coverage based on changes in financial obligations or family needs.

6. Planning for Long-Term Care on a Budget

A. Assess Long-Term Care Needs

Evaluate Risk: Consider your risk factors for needing long-term care, such as family history, health, and age.

Determine Coverage: Understand the types of care you might need and the associated costs, including in-home care, assisted living, or nursing home care.

B. Explore Affordable Options

Start Early: Purchase long-term care insurance while younger and healthier to secure lower premiums.

Shared Policies: Consider shared policies for couples, which can provide discounts and shared benefits.

Hybrid Policies: Look into hybrid life insurance policies with long-term care benefits, which can offer cost-effective coverage.

C. Build a Care Fund

Allocate Savings: Set aside funds specifically for future long-term care needs, separate from your emergency fund.

Use Tax-Advantaged Accounts: Consider Health Savings Accounts (HSAs) or similar accounts that offer tax benefits for medical expenses.

7. Maintaining Discipline and Financial Health

A. Regularly Review Your Finances

Monthly Reviews: Conduct monthly reviews of your budget, savings, and debt payments to ensure you are on track.

Adjust as Needed: Make necessary adjustments to your budget and financial plans based on changes in income, expenses, or goals.

B. Seek Financial Guidance

Consult Professionals: Work with financial advisors or planners for personalized advice and strategies.

Use Community Resources: Utilize free or low-cost financial counseling services available through community organizations or non-profits.

C. Stay Informed and Motivated

Educate Yourself: Continuously learn about personal finance, budgeting, and investing to make informed decisions.

Set Milestones: Establish milestones for debt repayment, savings, and insurance coverage, and celebrate your achievements.

Conclusion

Managing savings, debt, life insurance, and long-term care on a tight budget is challenging but achievable with careful planning, prioritization, and disciplined execution. By creating a realistic budget, focusing on debt reduction, building savings, and finding affordable insurance options, you can navigate financial responsibilities and work towards financial stability and security. Embrace the journey with patience and persistence, and remember that even small steps can lead to significant progress over time.